You’ll also need records of any other personal income in order to complete your tax return. If you’re self-employed as a sole trader or a partner in a partnership, then you have to keep records of your business income and expenditure. Records for sole traders and partnerships You could be fined up to £3,000 if you fail to keep adequate records. Having well-organised records will also make life easier when you come to file your annual Self Assessment tax return to HMRC.Īside from anything else, it’s a legal requirement to maintain accurate business records, and you’ll need to hold on to them for several years in case HMRC ever asks to inspect them. You might think of record-keeping as a chore, but it’s crucial for keeping tabs on the money flowing in and out of your business. If you’ve become self-employed and are wondering what sort of records you need to keep - and how long you need to keep them for - our guide will walk you through the basics. There are plenty of upsides to being your own boss, but many small business owners are daunted by the financial paperwork involved in going it alone. For example, you may want to keep copies of all your contracts for up to seven years, but you should probably keep auditor reports, annual statements and retirement plan records indefinitely.What records do small business owners need to keep? To stay compliant and avoid legal trouble, it may be important to keep copies of some records even after they’re not useful for day-to-day operations. You should have a security plan in place to keep this sensitive information safe. Include the customer name, products bought, phone number, email and mailing or shipping address. Keeping a copy of any contracts can also help you prevent disagreements in the future.Ĭustomer list: Depending on your business, it can be smart to keep track of your customers’ information so you can advertise deals or new products. Purchase order: A document which shows the official confirmation of an order by a buyer committing to pay the seller for the sale of a specific product or service in the future.Ĭontracts: Whether you sign a supply agreement with a vendor, rent a new piece of equipment or take out a business insurance policy, you should keep a copy of the contract in your records. The log should include date, a description of each expense and the amount.

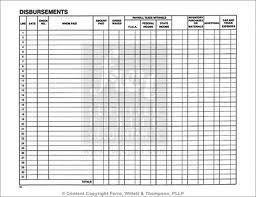

For each record, include the date, customer name, amount, date collected and status.īusiness expenses log: Here you’ll record the total amount of business expenses you have, such as rent, electricity, salaries and supplies. You can also include a list of customers who should not be provided with credit due to past failure to pay. This log includes a list of customers who owe you money, how much they owe and when the payment is due. It’s also useful to track discounts offered for early payments to help yourself remember to take advantage of them.Īccounts receivable log: An accounts receivable log lists the money that other people or businesses owe to a company for goods or services the company delivered. Keeping a solid accounts payable log will prevent you from being charged for the same product or service more than once. Include how much is owed, to whom, when payment is due and the date you paid it. Sales log: This log should include how much you sell per day, per week and per month, including the date, type of product or service and the amount of each sale.Īccounts payable log: An accounts payable log lists the money that a company owes other people or businesses. Here are some of the most important records to include: It may be online, on paper or a mixture of the two.

To start the recordkeeping process, determine a system for tracking transactions and other details. Protect your business in the event of an audit or employee issue.Access customer and employee information easily.Compare budgeted amounts to actual costs.Know how much money to invest to create your product or service.It can bring you peace of mind, help you monitor progress toward goals and save you time and money. Keeping clear records of income, expenses, employees, tax documents and accounts isn’t just good business. For small business owners everywhere, recordkeeping is a necessary and sometimes tricky part of making sure a business runs smoothly.

0 kommentar(er)

0 kommentar(er)